INS Market is a high-profile contemporary convenience store that provides a diverse range of food and beverage alternatives that are in great demand in the retail business on a regular basis. Their products provide healthy and balanced and tastier alternatives to a consumer pressed for time and looking for a quick meal or snack.

Since its inception in 1994, INS Market has grown to meet the needs of customers and the ever-increasing pace of life. INS Market is a specialty convenience store business offering a wide assortment of snacks and drinks. Stores typically range in size from 150 to 1000 sq. ft. and can be found in office complexes, malls, public transportation, hotels, and other locations.

INS Market Franchise.

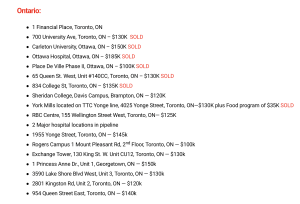

How much will it cost to open an INS Market? You can expect to pay $120,000 – $195,000 (C$) to buy an existing location. More than a dozen of these locations listed for sale right now on the companies website in Manitoba, Ontario, British Columbia, and Quebec.

Considering the number of INS Markets for sale, it makes you wonder if this is a good business to invest in right now. In this franchise review, I break down the strengths and weaknesses of this well-known convenience store concept. Take our 8-minute franchise quiz to find out if this business is right for you.

Financial Requirements and Fees

Deciding whether an INS Market franchise is for you? Here’s an itemized list of fees with corresponding highs and lows for each item which you’ll need to be familiar with upon determining if this franchise is indeed for you.

|

Items |

Fees |

|

|

Low |

High |

|

| Initial Franchise Fee |

$30.000 |

|

| Initial Inventory | $20,000 | $45,000 |

| Leases and Security Deposits | $20,000 | $30,000 |

| Training Expenses | $3,500 | $5,000 |

| Turnkey Package Fee | $100,000 | $125,000 |

| Insurance | $1,000 | $1,500 |

| Legal and Other Professional Fees |

$15,000 |

|

| Additional Funds – 3 Months | $35,000 | $50,000 |

| Business Licenses | $1,000 | $2,000 |

| Grand Opening Advertisements |

$3,000 |

|

Financial Requirements

In order to obtain a franchise from INS market, you’ll need to have the following financial requirements to accomplish. INS Market also offers financing via a 3rd party financier.

|

Requirement |

Fee |

| Liquid Capital | $75,000 – $150,000 |

| Net Worth | $251,500 – $378,500 |

| Total Investment | $100,000 – $250,000 |

| Franchise fee | $30,000 |

Liquid capital is the funds you have access to or could obtain without a typical loan, such as equities, retirement savings, family, or cash on hand. This is referred to as liquid capital or cash required.

Net worth on the other hand is the difference between the worth of your assets, such as real estate, savings, and cash, and the entire worth of your debts and obligations. The total investment meanwhile illustrates the overall cost of getting the franchise up and running.

The franchise fee is the one-time payment that you must make to the franchise in order to become a franchisee. This only covers a portion of the startup costs and excludes expenses such as venue set-up, supplies, and marketing. In some situations, such as multi-unit acquisitions or veterans wishing to become franchise owners, several companies provide modest concessions on the initial investment.

How Much Profit Does INS Market Franchisees Make Per Year?

Average Gross Revenue Per Store: The average gross revenue per store depends on the unit and location.

- Full-Size Store (44 locations): $439,937 average sales

- Kiosks (4 locations): $400,025 average sales

- Non-Traditional Locations (7 locations): $387,664 average sales

Keep in mind that average sales hides that fact that some locations underperform significantly. For examples, according to the FDD one full-size store only produced $53,918 in revenue for an entire year. Obviously, it would be difficult to turn a profit off of this level of sales.

Industry Average Profit Margin:

The average convenience store in the United States brings in $1.47 million in gross sales. Based on the gross revenue figures above, the INS Market opportunity falls short of expectations.

Profit margins of every convenience store will vary depending on a company’s development potential, management capability, wages, and rent. According to Statista.com, the gross-profit margin of C-Store products range from 14.99% to 53.18%. Healthy snacks are some of the highest margin products a c-store can offer at 48.27% margin.

Projected Annual Profit Per Store: If you were able to generate a 30% gross profit margin on a gross revenue of $439,937 average sales, you would make a net-profit of $131,981 per year.

INS Market SWOT Analysis

INS Market, much like its market competitors, is based on retailing products in high foot traffic areas such as malls and airports. Here, we examine what makes INS Market click as well as its surface flaws and market opportunities.

Strengths of INS Market

Provides popular and great quality products. INS Market is just one of the few store chains which offer their customers a large selection of snacks and beverages on a daily basis. Along with having a broad collection of these products, they aim to provide their customers with healthier alternatives such as Better for You Market Place products.

Revenue sources are boosted by high foot traffic. Just like INS Market’s competitors, the grocery chain gains their revenue stream from heavy foot traffic locations such as their street locations, malls, universities, or wherever people are usually found. This ensures that their store would never lose clients that would certainly buy their products.

Basic in terms of operation. INS Market, like its competitors, is a modest retail operation that sells a variety of commonplace items such as snacks, sweets, groceries, soft beverages, coffee, tobacco products, over-the-counter medications, lottery tickets, toiletries, magazines, and newspapers. They stock up smaller quantities of goods unlike bigger retail shops and food businesses wherein you need to manage a wider part of the operations other than the end-products you need to sell.

The business model offers a variety of products for a wide range of consumers. Since they obtain fewer quantities of merchandise at higher per-unit pricing from wholesalers, convenience stores frequently charge much higher prices than traditional grocery stores or supermarkets.

INS Markets for Sale in Ontario.

Weaknesses

Site selection is key to success. Much like other businesses, site selection in key areas can determine your franchise’s success or failure. Since INS Market is primarily based in Canada and not as big as their world-renowned competitors such as 7-Eleven stores, site selection is critically considered as one of INS Market’s weaknesses. If we compare INS Market with 7-Eleven, as of 2020, there are already 9,522 7-Eleven stores scattered around the country. This is a huge challenge for potential INS Market franchisees as 7-Eleven has a much better head start in this business model.

Here’s the other thing. What happens when a location becomes less lucrative. Many malls are suffering from lower traffic levels. In some places, governments have forced businesses to temporarily shut down over the past 2 years. Site selection is critical in the convenience store businesses.

Changes in prices of goods and labor expenses can affect profit margins. Companies make their gross profit by deducting the costs of selling their goods from the income they receive from sales. Various factors affect the magnitude of the gross profit in small retail establishments because the gap for both success and failure is quite little. Retail store operators must understand how these elements affect gross profit and how they may regulate them.

U.S. market penetration. Being a company that was established in Canada, it’s fair to say that most of its outlets are located in Canada itself. Picture this, while 7-Eleven has over 9,000 locations in the U.S. as of 2020, it is reported that there are currently only 6 (you read that right), INS Markets located in the whole of the United States.

While these 6 units are all franchised, the disparity in their figures is mind-boggling. INS Market has to devise an ultra-aggressive strategy in order to just even be close to 7-Eleven’s locations. We haven’t even considered the great number of other small grocery chains coming after 7-Eleven which have also established their footing in the United States a long time already.

Healthy beverage alternatives.

Opportunities

Room for growth. Despite being a weakness, INS Market’s lack of locations around the U.S. can definitely turn into an opportunity for the organization. INS Market can slowly creep into the U.S. market and put a hold on its footing once it establishes its market presence.

It is never too late to penetrate an already well-established and crowded industry. Think of the energy drinks sector. Even if Red Bull held a majority share of the market early on, new players such as Monster Beverage held on to their ground and are now directly competing with the energy drink giant. Believe it or not, there are still new energy beverage drink companies sprouting out in a bid to challenge these energy drink behemoths.

Thinking about a Franchise? Take Our 8-Minute Franchise Quiz to Find the Best Option For You.

Opportunity for market growth. We can also look into the market growth opportunity for convenience stores. According to a study, global convenience stores revenues are anticipated to hit $4,902 billion in 2022. This means that INS Market has a lot of elbow room to go and expand into the global convenience store industry. If INS Market doesn’t do good in infiltrating the U.S. market, there’s always a whole lot of global markets they can go into and establish their market presence.

Huge in-store sales potential. There are studies that also show that in-store sales of convenience stores in the U.S. have reached average sales of $1.47 million. This means that there is huge potential for INS Market to enter and gain a share in the U.S. convenience store industry. INS Market’s push for offering healthier alternatives can also become an advantage in their favor as Millennials, as well as Gen Zers, are more conscious about their lifestyle than any other generation before them.

Threats

Extremely competitive market. The convenience store industry is a very large and competitive market, especially in the U.S. There are approximately 118 convenience store companies spread out across the U.S. and about 148,000 stores currently operating around the country as of 2020. This does not include the number of grocery chains that are present in each state. It’s a tight market that INS Market has to squeeze into.

Focus on malls. Historically, retail destinations like shopping malls were sure-fire locations for profit. In the current economic environment, malls are struggling to keep the doors open. Business Insider even reported 80,000 retailers are expected to close in the United States in the next 5 years.

Only a few years age, the majority of employees came to large commercial offices for work. But there’s been a long-term shift in remote work, especially if you conduct knowledge work or sales. As a result, the foot-traffic in corporate offices isn’t what it used to be.

Related Reading: Is the Total Cost to Open a Dollar General Worth the Investment?

Nearby stores impact sales. Given the number of convenience stores in each area in the U.S., this proximity among rival stores can potentially affect sales in a negative way. Competitor stores can suck out the revenue out of each other possibly eliminating competition in the process. This is why site location is important in order to survive the extremely competitive convenience store market.

Potential customers bringing snacks. Other factors as simple as people bringing their snacks can also potentially become a threat to INS Market’s possible expansion. Some people tend to bring their own snacks when they go out instead of the trouble of dropping by a convenience store. This mindset can negatively affect the sales of each INS Market location.

Is the INS Market Worth the Cost to Invest?

Owning and operating a franchise is never easy, and running an INS Market is no different. First and foremost, if you plan to invest inside the U.S. mainland now, you may have to think twice about doing so. Other than competing with several established convenience stores around the country, so far, INS Market only has 6 outlets. One of the big benefits of operating a franchise of any banner is brand recognition. Unfortunately, there’s not much recognition of this convenience store brand at all in the United States.

Fat Leaf Water lineup of sports beverages sold in c-stores.

Other than already being established in Canada for almost 3 decades already, they offer competitive advantages in their home base. Their store is somewhat contemporary and modern and offers high-quality value products. More than being just a convenience store, INS Market outlets also provide healthier alternative products which are best suited for today’s customers who are health conscious.

Related Reading: Is the Cost to Open a Steak ‘n Shake Worth the $10k Investment?

Investing in a convenience store has been a relatively simple business model is simple to operate. In the past, this business has been as simple as identifying an area with built-in foot traffic and ordering inventory. You don’t have to spend as much on advertising as other businesses since you have a captivated audience. However, as I’ve mentioned earlier, site location is still critical in this type of business.

Just like in any other investment you make in your life, take the time to figure out if this franchise is right for you. Will you enjoy operating a c-store? This may be a simple-to-manage type of business, but no business is perfect. And if you can’t find the right location, it can be next to impossible to turn a profit.

INS Market has adapted to the needs of today’s consumers and the ever-increasing complexity of life. The retail store has the most cutting-edge quick satisfaction shop on the market. The company is led by CEO Samuel Davis, who has earned a lot of press for the company’s continued expansion in the United States and Canada. His dedication to the company’s success over the last 25 years is shown in the continued expansion of INS Market locations.