In this series, I carefully review the FDD documents of difference franchise businesses. In this post, I carefully review the 397 page document from McDonald’s to look at the financial performance, risks, and any red flags that I found worth noting.

Keep in mind that while I’ve written about the food industry for more than a decade, I don’t know everything. You’ll want to conduct your own research and review of the FDD. Also, the latest FDD I could get was published in 2022 so make sure to get the latest FDD before becoming a franchisee with the latest data if you’re considering a franchise. You can also take our 6-minute franchise quiz to determine the right fast-food franchise based on your finances, passions, and even book a phone call to discuss your personal situation.

Average Annual Sales Volume Per Store

The annual sales volumes of domestic traditional McDonald’s restaurants that have been open for at least one year as of December 31, 2021, is as follows:

- Approximately 97% of these restaurants had annual sales volumes in excess of $2,600,000.

- Approximately 94% had annual sales volumes in excess of $2,800,000.

- Approximately 88% had annual sales volumes in excess of $3,000,000.

As you can see, the vast majority of operators will generate more than $2.5 million in sales per unit. While this performance is encouraging fast-food units like Chi-fil-A have seen average gross sales more than $8 million according to 2021 data. But if you look at per unit sales data from Subway, this sandwich chain only generates $440,000 in sales per unit. Overall, McDonald’s is in the top 10 of all fast-food chain for unit sales.

Are you lovin’ the McDonald’s business opportunity?

Average Sales per Unit:

- The average annual sales volume at McDonald’s during 2021 was $4,046,000.

- The median annual sales volume during 2021 for these restaurants was $3,902,000.

It’s important to note that there is a significant range in sales among fast food restaurants. Some restaurants, such as those located in high-traffic areas, can generate much higher sales than the average. Other restaurants, such as those located in less-desirable locations will generate much lower sales.

Initial Investment of McDonald’s Franchise

According to the information provided, the total acquisition and development costs for a McDonald’s franchise can range from $1,366,000 to $2,450,000. This includes a $45,000 franchise fee.

Related Reading: Take Our 6-Minute Franchise Quiz to Find YOUR Opportunity

Keep in mind, there may be other costs involved such as equipment, inventory, and training expenses. It is recommended to contact McDonald’s directly for more specific and up-to-date information on the total investment required for owning and operating a franchise.

McDonald’s menu flyer.

Ongoing Costs

Here are some of the ongoing fees that need to be paid according to the McDonald’s FDD document include:

Rent: This will be likely be your biggest ongoing cost as a franchise owner. As you can see, later in this review the McDonald’s Franchisor generates most of their revenue from franchisee rent. McDonald’s is not only a fast-food restaurant but a real estate company.

To calculate the annual rent based on each sales level from the provided Fixed Percentage Rent Rate chart, use the following formula:

Annual Rent= Gross Sales × Fixed Percentage Rent Rate

Let’s calculate the annual rent for depending on hypothetical store sales at different levels. As you can see, at the end of the year you’ll be paying hundreds of thousands of dollars in rent per year.

- $2,110,000.01 to $2,210,000 in gross sales

- Midpoint Sales: $2,160,000

- Annual Estimated Rent: $2,160,000

- $2,210,000.01 to $2,310,000 in gross sales

- Midpoint Sales: $2,260,000

- Annual Estimated Rent: $2,260,000

- $2,310,000.01 to $2,410,000 in gross sales

- Midpoint Sales: $2,360,000

- Annual Estimated Rent: $2,360,000

- $2,410,000.01 to $2,510,000 in gross sales

- Midpoint Sales: $2,460,000

- Annual Estimated Rent: $2,460,000

- $2,510,000.01 to $2,610,000 in gross sales

- Midpoint Sales: $2,560,000

- Annual Estimated Rent: $2,560,000

- $2,610,000.01 to $2,710,000:

- Midpoint Sales: $2,660,000

- Annual Estimated Rent: $2,660,000

For the sales level of “$2,710,000 and above”, the rent is established on a case-by-case basis, so we cannot provide a specific calculation.

These calculations provide an estimate of the annual rent based on the midpoint of each sales level. Actual rent would vary within each range based on the exact sales figure.

Modern signage for a McCafe.

Based on the McDonald’s Franchise Disclosure Document (FDD), here is the chart that calculates the Fixed Percentage Rent based on McDonald’s Total Acquisition and Development Costs:

| McDonald’s Total Acquisition and Development Costs | Fixed Percentage Rent Rate |

|---|---|

| $2,110,000.01 to $2,210,000 | 13.75% |

| $2,210,000.01 to $2,310,000 | 14.00% |

| $2,310,000.01 to $2,410,000 | 14.25% |

| $2,410,000.01 to $2,510,000 | 14.50% |

| $2,510,000.01 to $2,610,000 | 14.75% |

| $2,610,000.01 to $2,710,000 | 15.00% |

| $2,710,000 and above | Established on a case by case basis |

The Fixed Percentage Rent for new and relocated traditional restaurants is payable only if the monthly Gross Sales exceed the monthly base sales figure, which is computed by dividing the dollar amount of the Monthly Base Rent by the Fixed Percentage Rent rate. If you are purchasing an existing restaurant from a franchisee, this chart will not apply, as you will be assuming the Monthly Base Rent and Fixed Percentage Rent paid by the selling franchisee.

This chart provides a structured way for franchisees to understand the rent they would be expected to pay based on the total costs associated with acquiring and developing a McDonald’s restaurant. The percentage rent is a variable component that adjusts based on the total investment, ensuring that the rent remains proportionate to the scale of the restaurant’s operations.

- Common Area Maintenance Fee: This fee is specified in the Master Lease agreement.

- Annual Fee: Franchisees are required to pay an Annual Fee of $1,000 in January of each year.

- System Fee: This fee is based on the Gross Sales of the restaurant and consists of a 4% service fee plus a percent rent calculated using a chart shown above.

How Does the Franchisor Make Money?

Why would you want to know the financial health and stability of McDonald’s as a franchisor? For one, consistent or increasing revenues over the years can indicate a strong franchise system. This type of financial analysis can also provide insight whether or not the franchise model is successful and growing or declining.

The revenue from all franchised restaurants for the years 2019 – 2021 are broken down into rents, royalties, and initial fees. These represent total revenues collected by McDonald’s from all its systemwide franchised restaurants. Here are the revenues:

For the year 2021:

- Rents: $4,334.0 million ( increase from previous year)

- Royalties: $1,735.0 million ( increase from previous year)

- Initial fees: $24.9 million ( increase from previous year)

- Total Revenues from franchised restaurants: $6,093.9 million ( increase from previous year)

For the year 2020:

- Rents: $3,714.9 million ( decrease from previous year)

- Royalties: $1,526.4 million ( increase from previous year)

- Initial fees: $19.7 million ( increase from previous year)

- Total Revenues from franchised restaurants: $5,261.0 million ( decrease from previous year)

For the year 2019:

- Rents: $3,815.6 million

- Royalties: $1,518.0 million

- Initial fees: $19.4 million

- Total Revenues from franchised restaurants: $5,353.0 million

These figures represent the aggregate revenues from all franchised McDonald’s restaurants for the specified years.

Is McDonald’s Still Expanding in the United States?

The total number of outlets increased by roughly 1% from 2019 to 2020, but then declined 1.85% in 2021. This could be due to a number of factors, such as the COVID-19 pandemic, the economic recession, and changes in consumer behavior.

- Total Units in 2019: 8,146

- Total Units in 2020: 8,227

- Total Units in 2021: 8,074

Keep in mind, it’s unlikely that McDonald’s will ever experience explosive unit growth in the United States in the near future. This is a mature fast-food restaurant with a massive existing footprint in the United States. But the company is still a major player in the fast food industry and is likely to continue to be profitable and see steady expansion in growing markets. It a franchise is expanding year-over-year, it is generally viewed as a positive.

Total McDonald’s Units by State 2019 – 2021

| State | 2019 | 2020 | 2021 |

| Illinois | 617 | 616 | 610 |

| Indiana | 314 | 321 | 321 |

| Iowa | 147 | 146 | 143 |

| Kansas | 148 | 148 | 147 |

| Kentucky | 242 | 241 | 241 |

| Louisiana | 240 | 237 | 233 |

| Maine | 62 | 62 | 62 |

| Maryland | 230 | 234 | 225 |

| Massachusetts | 234 | 234 | 234 |

| Michigan | 480 | 488 | 485 |

| Minnesota | 226 | 226 | 223 |

| Mississippi | 144 | 143 | 140 |

| Missouri | 315 | 315 | 312 |

| Montana | 48 | 48 | 47 |

| Nebraska | 78 | 77 | 77 |

| Nevada | 131 | 130 | 126 |

| New Hampshire | 54 | 54 | 54 |

| New Jersey | 264 | 263 | 257 |

| New Mexico | 104 | 106 | 104 |

| New York | 617 | 593 | 584 |

| North Carolina | 466 | 459 | 454 |

| North Dakota | 25 | 24 | 24 |

| Ohio | 573 | 570 | 567 |

| Oklahoma | 183 | 184 | 182 |

| Oregon | 165 | 162 | 158 |

| Pennsylvania | 494 | 491 | 486 |

| Rhode Island | 31 | 31 | 31 |

| South Carolina | 221 | 222 | 221 |

| South Dakota | 30 | 30 | 29 |

| Tennessee | 327 | 327 | 322 |

| Texas | 1,134 | 1,137 | 1,118 |

| Utah | 116 | 113 | 110 |

| Vermont | 26 | 26 | 26 |

| Virginia | 362 | 364 | 362 |

| Washington | 238 | 238 | 232 |

| West Virginia | 103 | 103 | 103 |

| Wisconsin | 23 | 19 | 19 |

Is there a Way Out?

The standard franchise term for a McDonald’s restaurant is 20 years. If you don’t want to operate a McDonald’s before the term ends here are some of the options.

- If you no longer wish to operate the franchise, you might consider selling it to a qualified buyer. Upon the sale and meeting certain conditions, McDonald’s may offer a new term franchise to the qualified buyer upon the expiration of the existing franchise.

- If a franchisee intends to sell or transfer their franchise, they must give McDonald’s written notice at least 20 days prior to the proposed effective date. This notice should include details of the proposed purchaser and the terms and conditions of the offer.

McDonald’s has the first option to purchase the restaurant on the same terms as the offer. If McDonald’s does not exercise this option and the restaurant is not sold to the proposed purchaser, McDonald’s retains the first option to purchase the restaurant on the terms of any subsequent offer.

You can also ask McDonald’s to rewrite the term policy to end at a sooner date. Keep in mind there’s no guarantee the franchisor will let you out of an existing contract.

Legal Challenges

The company is currently facing several legal challenges. These include labor and employment lawsuits brought by employees of franchisees, alleging joint employment and various violations such as racial discrimination, sexual harassment, wrongful termination, and wage and hour violations

A few of the legal cases the company is currently facing is listed below:

- Luis Canizares Gonzalez and Luis Canizares Restauracion, S.L., v. McDonald’s Sistemas de España Inc, Sucursal en España (MSE) and McDonald’s Corporation (Case No. 559/2014)

- Farah Gohari v. McDonald’s Corporation, et al. (Case No2016-CH-08261)

- Leinani Deslandes, et al. v. McDonald’s USA, LLC, and McDonald’s Corporation and Does 1-10 (Case No. 1:17-cv-04857)

- Stephanie Turner v. McDonald’s USA, LLC and McDonald’s Corporation (Case No. 1:19-cv-05524)

- Christine Crawford, et al. v. McDonald’s USA, LLC and McDonald’s Corporation (Case No. 1:20-cv-05132)

- Jeong-Su Kim, et al. v. McDonald’s USA, LLC and McDonald’s Corporation (Case No. 1:21-cv-05287)

- Kytch, Inc. v. McDonald’s Corporation (Case No. 1:22-cv-00279)

The FDD also mentions that there are recent cases related to cybersecurity breach, antitrust violations, and discrimination against Black franchisees.

Red Flags with the McDonald’s Franchise

After reading the FDD document, here are some red flags that stood out to me. I would investigate these further before investing in a McDonald’s franchise.

High Reliance on Rent Revenues: The McDonald’s franchisor owns the real estate a franchisee operates the fast-food business model.

- Why I would explore further: Owning real estate can be both an asset and a liability for a franchisor. If the market faces a downturn, the franchisor could be left with unprofitable properties. It’s also worth exploring if the franchisor is charging above-market rents, which could strain franchisees by cutting into profits.

A variety of McDonald’s menu items.

Small Increase in Royalties: While there was an increase in royalties from 2019 to 2020 and 2020 to 2021, the growth rate is relatively modest especially compared to the growth in rent income.

- Why I would explore further: Royalties are typically a percentage of sales. Modest growth could indicate that franchisees’ sales are not growing robustly, which might be a sign of operational challenges or market saturation.

Related Reading: Will In-N-Out Burger Ever Franchise? (Cost + Startup Process)

Increase in Initial Fees: The increase in initial fees from 2019 to 2021 might indicate that the franchisor is focusing on onboarding new franchisees.

- Why I would explore further: If the growth strategy is primarily based on adding new franchises rather than ensuring the success of existing ones it could be a sign of a short-term growth strategy, which might not be sustainable in the long run.

Litigation History: There were numerous legal challenges that the FDD discusses. I would dive deeper into the litigation that involves other franchisees. This will give you a sense of some of the challenges that existing franchisees have with the business model.

- Why Explore: Frequent litigation can be a sign of strained relationships between the franchisor and its franchisees, indicating potential operational or contractual challenges.

Keep in mind this is not a comprehensive list of items to investigate. These are just a few items that stood out to me for further analysis.

Reasons to Like McDonald’s Franchise Business

Of course there’s still plenty of reasons to like the McDonald’s franchise opportunity:

Strong brand recognition and global presence: McDonald’s is one of the most recognizable brands in the world, with over 39,000 restaurants in over 100 countries. This gives McDonald’s a significant advantage over its competitors, as it can easily attract new customers and grow its business.

Proven business model: McDonald’s has a proven business model that has been successful for over 60 years. This model is based on a few key principles, such as offering a limited menu of affordable, high-quality food, providing fast and efficient service, and operating in high-traffic locations. The concept has proven it can be successful in booming economic time periods and recessions alike.

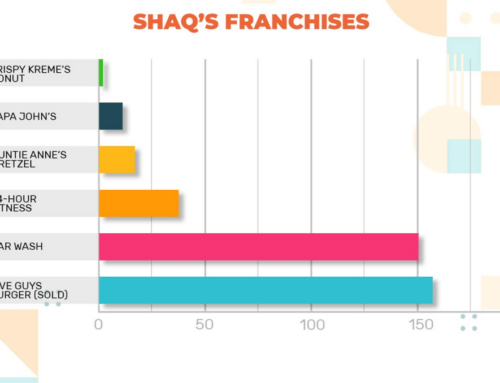

Related Reading: What Franchise Restaurants Does Shaquille O’Neal Own Now?

The data indicates low termination rates in most states, suggesting that most franchisees continue to operate their McDonald’s outlets without significant disruptions and aren’t going out of business. In many states, the number of McDonald’s outlets has remained stable or even grown. For instance in New York (2019-2021), The number of outlets increased from 593 in 2019 to 595 in 2021. In North Dakota (2019-2021), the outlets remained stable at 24 in 2019 and 2020 and increased to 25 in 2021.

Constantly innovating and adapting: McDonald’s is constantly innovating and adapting to changing consumer preferences. For example, the company has introduced healthier menu options, such as salads and fruit smoothies, and it has also expanded its delivery and mobile ordering services. This shows that McDonald’s is committed to staying ahead of the competition and providing its customers with what they want.

In conclusion, the Franchise Disclosure Document (FDD) for McDonald’s provides a comprehensive overview of the franchising terms, financial expectations, and operational requirements associated with owning and operating a McDonald’s restaurant. The standard franchise term is set at 20 years, with specific conditions and options available at the end of this period.

Additionally, the document sheds light on unique franchise arrangements like the Business Facilities Lease (BFL) and the financial commitments expected from franchisees. Prospective franchisees should thoroughly review the FDD, ideally with the assistance of legal and financial professionals to make sure you have a clear understanding of the obligations, opportunities, and potential challenges of entering into a franchise agreement.