For more than 80 years, Dollar General has been selling discount products for the ordinary guy and gal on a budget. Dollar General services communities from right around the corner and across the country with nearly 18,000 locations. Dollar General’s food, personal care, cleaning, and other every-day products range from high-quality private labels to the most recognized global brands.

Dream of opening a Dollar General of your own? Unfortunately, you can’t. Dollar General is not a franchise opportunity at this time and the stores are all company owned / operated. Bummer!

Dollar General Official Website.

If you could open a Dollar General, you’d likely need to investment between $250,000 – $600,000 based on the industry. According to financial reports, Dollar General brought in a mind-boggling $33+ billion in sales across all of their stores last year so this would be a good business to evaluate if it was possible to join in the future.

I’ve broke down the startup cost, average revenue and a SWOT analysis of this bargain chain to help you identify if it’s worth an investment. Here’s my break down for this corner store chain’s profitability ratio, prospects, and risks. Take our 8-minute franchise quiz to find out if a discount retailer is right for you.

Financial Requirements and Fees

Even though you can’t buy a Dollar General franchise, it’s important to understand the costs, fees, and detailed financial requirements of retail stores in this industry. Dollar General has numerous competitor concepts that you can invest in so understanding these ball-park startup costs is important.

|

Requirements |

Amount |

| Liquid capital | $20,000 or more |

| Net worth | $50,000 |

| Total investment | $250,000 to $600,000 |

| Franchise fee | $20,000 to $50,000 |

| Royalty Fee | 3% (Dollar Discount Store of America) |

Financial Requirements

While you can’t open a Dollar General, there are three alternative dollar concept stores that you could open. Since Dollar General stores are controlled by the company, you may never be able to acquire a franchise unless they change their strategy. However, this does not rule out the possibility of leasing a store.

You could contact them on their webpage and have a conversation with them if you want to. Varied shop models have different prices at Dollar General Franchise stores. The sorts of stores they operate, as well as the exact Dollar General Franchise fee, are shown as follows.

- Liberty Dollar Store – In terms of pricing and maintenance, this store, which is part of the Dollar General Stores chain, is the simplest and cheapest to manage. They are self-contained and require little oversight from their parent corporation. A Liberty Dollar Store can be started for as little as $25,000. This may vary based on your loading preferences as well as the place where you plan to set it up.

- Dollar Discount Store Of America – It may only take a $75,000 upfront outlay limited to a maximum of $150,000 for a lower-priced business. It’s not the least expensive type of retailer, but it’s significantly less expensive than Just-A-Buck. To be approved into the franchise, you must provide collateral and have excellent credit. The lower cost will show up in the volume and quality of your first and ongoing inventory.

- Just-A-Buck – The far more complex and costly Dollar General store variety, this one will take an initial outlay of at least $150,000 to $300,000 to get it up and running. All this doesn’t even include the $50,000 franchise fee. One of the requirements for launching this type of business is a 10-year commitment to the franchise, regardless of whether or not it generates the sales you desire.

As you can see the dollar store concept is alive and well. The reality is there will always be a customer base looking for fair deals on the necessities of life.

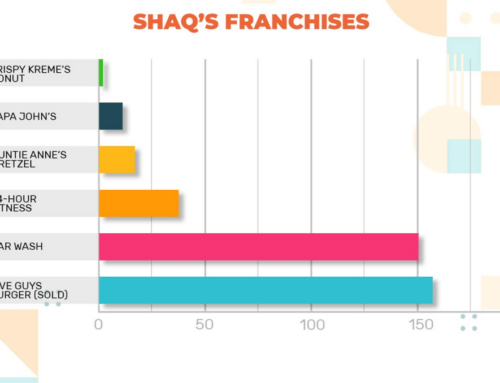

How Much Profit Does A Dollar General Franchisees Make Per Year?

Company revenue/sales per year

Despite the global challenges, Dollar General’s annual revenue for the fiscal year 2021 was $33.747 billion, up 21.59 percent from the previous year. The sum of money received by a corporation from its consumers in compensation for the goods sold or services is referred to as revenue. To arrive at net revenue, all expenditures and expenditures must be removed from revenue on an income statement.

Related Reading: Is the Cost to Open a Steak ‘n Shake Worth the $10k Investment?

Dollar General’s year-on-year sales have been growing steadily in the past five years. From 2017, it had an average of 11.44% year-on-year growth with the highest jump recorded from 2020 to 2021 with a 21.59% jump. Perhaps the occurrence was brought about by panic buying for supplies when the pandemic hit last 2020. Either way, sales continue to be strong coming out of the health crisis.

Number of units

Dollar General is the largest retailer in the United States in terms of store count with over 18,000 locations across 46 states. A reported 75% of the population of the United States lives within five miles of a Dollar General shop.

Dollar General aims to open 1,110 stores in 2022 and also plans to expand globally. The planned development includes putting up to 10 stores in Mexico. This should result in even higher revenues at the end of the year.

Average Gross Revenue Per Store

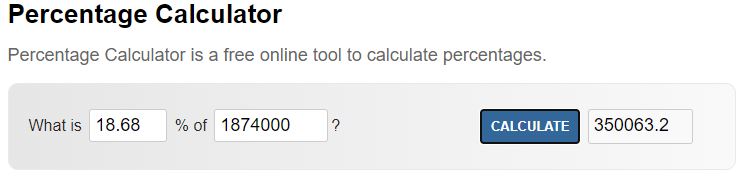

$33.74 billion (System-wide sales) ÷ 18,000 units = $1.874 million.

Industry Average Profit Margin

Revenue climbed 7.23 percent faster than Gross Profit increased 3.17 percent, resulting in a decrease in Gross Margin to 18.68 percent, which was below the industry average. In the fourth quarter of 2021, the gross margin declined to 19.25 percent on a trailing twelve-month basis.

Projected Annual Profit Per Store:

The median industry profit margin is relatively modest considering other data suggesting Dollar General averaging above 30% in the past five years of operations. The industry’s sudden drop can be attributed to the ongoing pandemic, inflation, and supply chain issues that have plagued so many other companies.

Comparing pricing and purchasing from across the globe is fairly easy than before thanks to the Internet. Retailers have also struggled due to low-cost overseas competition. At the end of the day, Dollar General makes money through sales volume. Massive volumes of sales can still lead to incredible end of year profitability.

Thinking about a Franchise? Take Our 8-Minute Franchise Quiz to Find the Best Option For You.

When it comes to discretionary things, consumers can afford to be frugal and selective since they make quick selections and can frequently make up their minds and return purchases without penalty. This indicates that demand for retail goods is somewhat elastic in terms of price, making price increases difficult.

Dollar General SWOT Analysis

Dollar General’s primary competencies include strategically located stores, high-quality brands, a broad choice of general merchandise, and affordable prices, which provide the company an edge over its competitors.

Dollar General’s business philosophy is guided by the slogan “Save time. Save money. Every day,” which emphasizes providing a convenient and straightforward purchasing experience for the customer.

Dollar General’s greatest asset is its extensive, broad, widely used, and day-to-day product offering. Inventory includes everyday items like groceries, snacks, health and beauty aids, household cleaning products, everyday wear, housewares, and seasonal items at affordable prices in nearby areas, all under the umbrella of America’s most trusted brands and Dollar General’s premium private brands.

Dollar General offers mostly canned food items to reduce waste.

One of Dollar General’s major flaws is its lack of global presence in relation to the competition. Dollar General, on the other hand, could use the chance to explore worldwide markets, particularly emerging economies to overcome this vulnerability.

Dollar General’s high-return, low-risk real estate growth plan focuses on capturing growth potential. For the year 2020, the group plans to open almost 1,000 retail locations, rehabilitate 1,500 existing stores, and move 80 stores across the country. Top competitors such as Costco Wholesale, Target Corporation, and Walmart, don’t pose a serious competition to Dollar General. They are not exactly direct competitors.

Strengths

Established reputation as a low-cost store. Dollar General, which has a reputation for being the next-door store with low-cost inventory. Dollar General sells at lower prices than those same items found in supermarkets and medicine stores.

Dollar General is able to keep prices low in a variety of ways. First, the company operates mostly in rural and suburban regions where monthly lease costs are lower.

It offers well-known brands, and so its small product variety provides it more negotiating leverage with suppliers from whom it purchases in bulk. They will also buy excess inventory at a discount from other big retailers.

Labor costs are also reduced by having fewer products in stock than grocery stores as well. Dollar General carries limited fresh produce so there’s minimal loss in inventory due to spoilage. The Dollar General model is all about reducing waste and operating lean.

Consistent same-store sales growth for the past 30 years. Dollar General reported strong same-store sales growth for the 30th consecutive year in 2019. This expansion is primarily due to Dollar General’s consistent value-proposition for customers. Dollar General’s convenience offering, which includes locations close to customers’ homes, also contributes to its success.

- Highly skilled workforce of over 90,000 employees. Through effective learning & development initiatives, Dollar General maintains a highly qualified workforce. Dollar General devotes significant resources to employee training and development, resulting in a team that is not just highly competent but also eager to attain greater success compared to other dollar retail concepts.

- Combining complementary businesses. Dollar General has a long history of successfully merging and acquiring complementary businesses. In the last few years, it has effectively integrated a number of technology businesses to streamline operations and develop a stable supply chain.

- Product Development & High-Quality Food. Dollar General is a rapidly expanding enterprise that has always put its customers first by delivering the highest meals. These meals are prepared efficiently in accordance with customer preferences. Dollar General meals come in a variety of flavors, and these are also versatile. Hand-tossed pizzas, potato wedges, cheesy-garlic bread, and parmesan bread are just a few of the Dollar General products that have been manufactured over the past 50 years. In addition, there is also a “Cookie Brownie” in their sweet dish. Tasty pasta is also available. Every taste of Dollar General treats leaves an indelible impression on the client’s mind.

- Well-established distribution network. Dollar General has created a dependable distribution network that can cover the entirety of its prospective market over time. Dollar General has maintained its supply chain, which is its most important asset. They can expand their distribution to every part of the globe in order to maintain their global market goals.

- Dependable suppliers. Dollar General’s suppliers are dependable and renowned. Furthermore, they deliver goods and materials on schedule, completing the supply chain management process. It has built a strong foundation of dependable raw material suppliers, allowing it to bypass any supply chain bottlenecks that smaller competitors might encounter.

- Social media presence. Dollar General has a huge social media following, comprising millions of followers on Instagram, Twitter, and Facebook. On these platforms, there is a high level of customer engagement and a quick reaction time. Dollar General will frequently feature special deals on social media that generate interest for the brand.

Weaknesses

- Poor forecasting. Dollar General is not always adept at estimating product demand, which results in a larger rate of missed chances than its competitors. Dollar General is not particularly excellent at demand forecasting, thus it ends up retaining greater inventory both in-house and in the channel. This is one of the reasons why the day’s inventory is high in comparison to its competitors.

Franchise Review: Is the Total Cost to Open a 7-Eleven Franchise Worth It?

- Accounting transparency. Dollar General Corp was fined $162 million on April 30, 2001, for making misleading statements or neglecting to disclose unfavorable facts regarding the company’s financial status. Relating to financial issues, including suspicions of fraudulent behavior, the corporation has declared that its earnings for the previous three fiscal years will be restated. Dollar General said on March 3, 2005, that it would revise its results for the years 2000 to 2003 in the wake of the SEC’s explanation of lease-accounting issues.

- Fines imposed by OSHA. The Occupational Safety and Health Administration (OSHA) penalized Dollar General $51,700 in November 2014 during an examination of a shop in Brooklyn, Mississippi. Dollar General has been cited by OSHA for recurring health and safety violations: “Since 2009, OSHA has undertaken 72 inspections of Dollar General nationwide, 39 of which have resulted in citations.” In April 2016, OSHA disclosed that the store had received additional citations for exposing employees to electrical hazards related to missing faceplates on electrical outlets. A penalty of $107,620 was imposed on the shop. OSHA reported in December 2016 that several Dollar General stores continued to obstruct fire exits with stock, despite safety breaches that resulted in multiple fines.

- Limited success other than their core business. Despite the fact that Dollar General is one of the leading companies in its industry, the company’s current culture has made it difficult to expand into other product areas. Fortunately, the company hasn’t needed to stray far from its proven strategy.

Opportunities

- Online customers. The corporation has invested a great deal into the online network over the last few years. Dollar General gained access to additional sales channels as a result of its transaction. In the next few years, the corporation can capitalize on this potential by getting to know its customers better and meeting their demands using big data analytics.

- Changes in the economy. As far as we can tell, financial circumstances have improved all over the world. Because of the high employment ratio in Asian and European countries, clients have considerable spending power. Dollar General Corporation A’s remarkable feature is that it is unaffected by client purchasing power. Taxes will become more expensive if the government imposes them. Dollar General Corporation A prices are presently constant due to various nations’ financial policies.

- Consistent financial flow. The ability to invest in neighboring product sectors is made possible by stable free cash flow. With greater cash on hand, the corporation will be able to invest in new technologies and product sectors. Dollar General should be able to expand into new product categories as a result of this.

Generic and brand name sodas are sold at Dollar General.

- Innovations in technology. Most business units benefit from technology. To cut expenses, operations can be streamlined. Technology boosts consumer data collection and marketing efforts. Dollar General may now use new technology to implement a distinct pricing strategy in the new market. This would help the company to keep its existing consumers by providing excellent service while also attracting new customers through additional value-oriented initiatives.

- Changes in consumer behavior. Consumers in the business are becoming more health-conscious, and this is a rising market. Dollar General can profit by producing things that viewed as healthy, non-diary, or organic. Opportunities to collaborate have opened up as a result of the brand-new patterns in client habits. Dollar General can use cognitive advertising to influence consumers’ decision-making processes.

- Government policies. The importation of goods has seen a reduction in trade restrictions. This would cut down on the expenses of production factors. In this area, the government has also offered a subsidy for the selling of ecologically friendly goods. Dollar General can capitalize on this opportunity by focusing on these environmentally-friendly products.

Threats

- Competitor technological advancement. New technical breakthroughs by some of its competitors within the industry constitute a threat to Dollar General, as customers drawn to the new technology may ignore Dollar General in favor of rivals, reducing Dollar General’s share in the market. In the medium to long term, new technologies produced by competitors or market disruptors could pose a severe challenge to the business.

- Changing political landscape. Political uncertainty in the country can be a stumbling block for businesses, causing them to underperform and pay excessive costs. Increased taxes or labor costs could negatively impact this business in the sector.

- Competitor promotions. Dollar General has been threatened by intensified marketing by its competitors. Shoppers are pummeled with various messages in most media, and there is more distraction than ever. Dollar General’s sales promotions may lose their impact as a result of this.

- Marketable products. Demand for highly profitable items is seasonal, and any external factor during peak season could have a short- to medium-term influence on the company’s financial performance. As demand for current products declines, the number of replacement products accessible is growing, posing a danger to the entire sector.

- Rising costs. Dollar General’s operating expenses have grown as fuel prices have surged. These costs have also risen as other businesses that offer supplies to this company have been hit by rising gasoline prices, resulting in higher charges. Dollar General’s current operations and products include a number of costly functions. They lack any analyses or strategies for controlling their expenditures, such as labor and raw material costs, which are rising daily. To avoid this problem, the organization can engage in cost-cutting methods.

- Consumer behavior. Consumer preferences are shifting, putting pressure on businesses to constantly adapt their offerings to satisfy the demands of these clients. The present physical infrastructure-driven supply chain paradigm may be threatened by changing customer buying behavior through internet channels.

Is the Dollar General Worth the Cost to Invest?

If you could invest in a Dollar General franchise, it would certainly be worth taking a look at. But that’s not the reality. You’ll need to find an alternative dollar or grocery store instead of this is your goal.

Dollar General provides convenience to millions of customers and raises brand exposure by having a store within five miles of 75 percent of the population in the United States. Dollar General, Dollar Tree, and Family Dollar (owned by Dollar Tree) not only flourish in a booming economy, but they also increase steadily throughout downturns.

Dollar General has 17,700 stores at the end of 2020, further than Dollar Trees (DLTR), 1.9 times the number of Walgreens (WBA), and 1.2 times the combined store count of Walmart (WMT), Kroger (KR), Target (TGT), Big Lots (BIG), Five Below (FIVE), and Albertsons (ALB) (ACI).

Related Reading: Can You Be Fired From a Franchise Business You Invested In?

Despite the fact that actual retail sales are dropping, Dollar General keeps growing sales in existing stores and adds about 1,000 new sites every year. “Our two-year same-store sales for the second quarter of 2018 were the greatest in 10 quarters,” CEO Todd Vasos revealed in 2018. “Due to increased customer productivity, we saw 2.9 percent same-store sales growth.” Why does this matter? Because the ongoing expansion of an established store produces an investment that is almost risk-free.

Dollar General is rapidly growing its presence. During the pandemic, Dollar General’s market share of U.S. retail outlets expanded even more as many smaller retailers closed their doors. In 2020, Dollar General stores accounted for 5.2 percent of all brick-and-mortar establishments in the United States, up from 3.5 percent in 2018. In 2021, the company expects to open 1,050 new outlets.

And while it’s hard to tell whether dollar stores would survive a recession with 100% confidence, history has shown that they will grow and remain consistent in good times and bad. Other companies that cater to middle-class customers, such as J.C. Penney haven’t faired so well. Customers are fleeing JCPenney, Kohl’s, and Macy’s. On the other hand, Dollar stores are gaining ground and would likely do so as other merchants struggle to do so as long as customers value savings on the basic necessities of life.

Father and son James Luther “J.L.” Turner and Cal Turner started the business at Scottsville, Kentucky back in 1939 as a family-owned enterprise named J.L. Turner and Son. The company’s name was changed to Dollar General Corporation in 1955, and it began trading on the New York Stock Exchange in 1968. Dollar General was first listed by Fortune 500 in 1999, and by 2020, it had risen to #112 on the chart.