Had pizza delivered the last two weeks? You’re not alone.

If you can’t leave your house and need a meal… The first thing that comes to mind is getting pizza delivered based on the latest industry data and research.

Spoiler Alert: Some pizza chains doing well before the global pandemic could see even more growth due to the sudden stay-at-home economy. Learn what pizza chains benefit most from these changes and ways small pizzerias will need to adapt to stay open for business inside this industry report.

Post Covid-19 Pizza Industry Trends

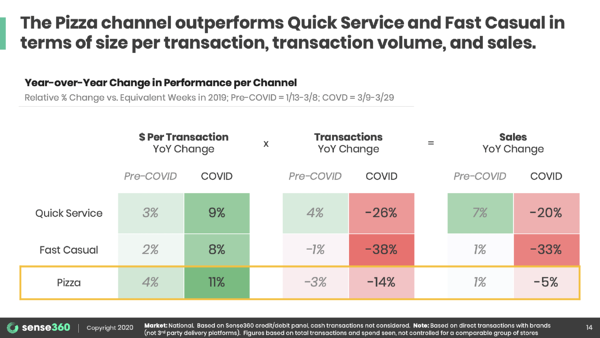

Pizza chain ticket sizes increased by 11% post-COVID. This outperforms the average ticket increase of Quick Serve Restaurants and Fast Casual.

Increase in average ticket sizes for pizza chains.

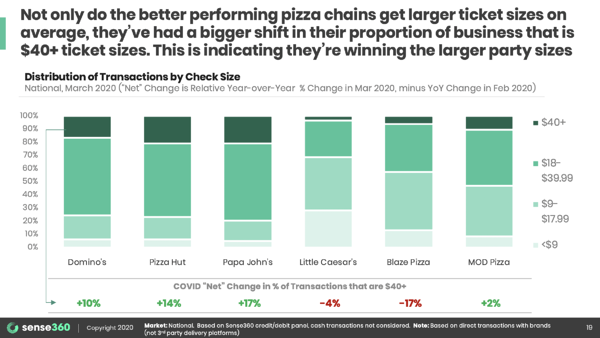

The number of $40+ transactions is up 10% or more for Pizza Hut, Domino’s, and Papa John’s post COVID. People are ordering larger quantities and looking for leftovers. Leftover pie for breakfast? Yes, please.

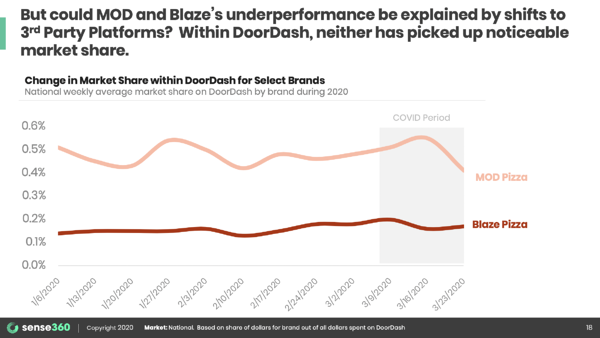

Increases in online delivery through third-party apps like DoorDash are benefiting some chain pizza chains more than others. The artisanal chain Blaze Pizza does not seem to be benefit from the spike in online orderers through third party apps. Smaller ma-and-pa shops are also less likely to get sales here too.

Families are seeking overall value of establishments like Dominos. Over 70% of measured ticket sales are over $18. More artisan pizza shops are seeing more tickets under the $18 mark, suggesting orders from individual or dual households.

Total sales declined by 14% for pizza chains overall post COVID. Some speculate that consumers want more diversity in delivered meals after being quarantined for a couple of weeks.

This data was researched and published by Sense360. Check them out! They did a fantastic work number crunching data referenced in this piece.

Pizza Consumption Trends in the United States

The number of $40+ tickets are up for many chains.

Little Caesars, Domino’s, Papa John’s, and Pizza Hut are among the key pizza chains in the U.S. (Statista)

An average of 350 slices of pizza is sold every second. (Alto-Hartley)

The most ordered pizza is Pepperoni, taking up 36% of the total share. (Food Business News)

In the fast-food market, the pizza industry remains part of the top 3 in terms of market growth. (Hungry Howie’s)

In a Technomic report, pizza eaters consider authenticity important with 49% of consumers craving original pizza from their favorite pizza parlors. (Restaurant Business)

In the U.S., the most popular pizza day of the year is Super Bowl Sunday. Seventy percent of those watching eat at least one slice of pizza during the event. (Alto-Hartley)

61% of Americans go for thin crust pizza. (Food Business News)

Pizza companies placed 2nd among the QSR industry with a 15% share, with hamburger companies taking the biggest share with 30%. (Restaurant Dive)

In a survey of pizza operators in 2015: Pizza Chain operators had a 2015 revenue of $23.5 billion with a +3.38% year on year change, while Independent operators had a $14.9 billion at -5.01% YoY. Four years ago, it can be seen that pizza chains were substantially outpacing the independent pizzeria operators. (Franchise Help)

As observed from this 2015 survey, pizza chains have long been eating away the pizza market share from independent chains. In 2015, there was a 2% shift towards the big pizza chains, now these chains own 61% of the total market share. (Franchise Help)

There are currently about 93,687 pizza businesses in the U.S. (IBISWorld)

Reduced cooking time is turning into positive growth for the wood-fired pizza industry. The market is expected to grow at a CAGR of 5% from 2017 to 2021. (TechNavio)

In 2017, Domino’s dominated the pizza market amassing approximately $6 billion in sales with an 11% growth from the previous year. The previous top seller, Pizza Hut, on the other hand, dropped to $5.5 billion in sales, a decline of 4.2% (Restaurant Dive)

The presence of different toppings, as well as the surge in consumption of packaged and frozen foods, are fueling the growth of the frozen pizza market. (IndustryArc)

According to research by Packaged Facts of the top 30 frozen pizza brands, around 1/3 of these brands associate their products with health and wellness. (Packaged Facts)

Pizza is a global food, as such, much of today’s pizza flavors offer local ingredients and toppings which attract the domestic market. South Korea for instance, offers toppings which include kimchi and bulgogi. In India, pizza shops offer vegetarian toppings which are a staple in the country.

Industry Report: 27 Meal Kit Industry Statistics and Consumption Trends

Approximately 83% of consumers chow down pizza at least once a month, according to research by Technomic. This shows that the pizza industry remains steadfast despite changing consumer preferences. (PMQ Pizza Magazine)

Pizza lovers have a lot of choices with more than 95,000 pizza shops spread across the country. Adding to these are new varieties such as frozen pizzas sold in grocery and convenience stores. (Food Business News)

Pizza Shop Data in the United States

Pizza doesn’t need to be touched after it leaves the oven.

Averaging 5.1k customers per pizza shop, the U.S. pizza market is considered to be quite saturated. (AaronAllen & Associates)

About 3 billion pizzas are sold each year in the U.S. (Alto-Hartley)

Chain and independent pizzerias are retaining their position in the U.S. pizza industry with sales of 59% and 41% respectively.

The U.S. pizza industry employs approximately 1,042,425 people in the country. (IBISWorld)

Americans continue to crave for pizza as 43% of pizza eaters order at least once a week. (Restaurant Business)

Italian pasta and pizza parlors, as well as pizzerias, make up 13% of the total restaurants in the U.S. (Food Business News)

Americans are more inclined to go for QSRs and order pizza online instead of the conventional sit-down pizzerias. This preference has stunted the growth of the industry. (IBISWorld)

Among the U.S. pizza giants, Pizza Hut and Domino’s just ranked 7th and 5th respectively. They were outranked by pizza companies like Pizza Ranch and Papa Murphy’s as America’s favorite pizza chains. (Statista)

In 2018, when the U.S. pizza market was approaching approximately $46 billion in revenue, the leading pizza chains owned 60% of the total market share or about $26 billion. Small-scale and independent pizza chains, on the other hand, were worth $19 billion. (Restaurant Dive)

Pizza Hut and Domino’s accounted for 50% of the total U.S. sales in 2017. When you add Papa John’s and Little Caesars to the equation, these pizza chains account for 79% of the total pizza sales among the top 200 pizza chains. (AaronAllen & Associates)

Menu Spotlight: Economics of the Fried Chicken Sandwich

Pizza lovers spend a whopping $33 billion in QSRs every year in the country. Around $15 billion come from takeout services, while close to $10 billion come from pizza delivery. (Statista)

Around 17% of the total restaurants in the country are pizza parlors, and out of this 17%, more than 10% are based in New York City. (Alto-Hartley)

In a 2018 Technomic’s Pizza Consumer Trend Report, 37% of menus nationwide include pizza. This means that there’s considerable competition for consumers’ choices. (Restaurant Business)

The Global Pizza Market

Pizza started in Italy, but is now enjoyed globally.

Pizza places around the world are booming, having a growth rate of 10.7 % through a 5-year forecast. (PMQ Pizza Magazine)

There are about 13,500 people for every pizza parlor in the U.K., while there are 370,000 and 353,000 residents per pizzeria in China and India respectively. (AaronAllen & Associates)

In the forecast period between 2016 to 2020, the pizza market is seen to enjoy continuous growth with a CAGR of 3% (TechNavio)

A boom in fast food channel among developing economies and improvements in freezing technology are just some of the opportunities with which key players in the global pizza market can take advantage of. (Refrigerated & Frozen Foods)

Pizza chains have declined domestically but globally, some of the industry’s key players are continuously expanding. In the 3rd quarter of 2017 up to 2018, Domino’s have hiked into 232 units globally, Yum! Brands (Pizza Hut) added 192, while Papa John’s expanded to 146. (PMQ Pizza Magazine)

The global pizza market is expected to hit $233.26 billion by 2023 with a CAGR of 10.17%, year on year from 2019 through 2023. (BusinessWire)

In market research made by Trends Market Research in London, the global frozen pizza market was worth $12.20 billion in 2017. The market is projected to hit $20.80 billion by 2026 with a CAGR of 6.59 % (Refrigerated & Frozen Foods)

North America is the largest pizza market in the world apart from Europe.

The growing demand for gluten and frozen pizzas in Sweden and Norway, the emergence of online pizza delivery in France, and the conformity of domestic pizzerias on different sales channels make Europe the fastest growing regional market in the pizza industry. (BusinessWire)

Due to its growing economy, international pizza companies projected to open around 1,300 new shops in China last year.

Pizza Industry Trends

Blaze Pizza does not appear to be benefiting from the current economic environment.

The emergence of online ordering, the rise of organic ingredients, and the use of social media are just some of the vital trends which are expected to drive the growth of the pizza industry in the coming years. (TechNavio)

More Americans are shifting into a healthy lifestyle, thus healthy food options have become popular as well. Most restaurants already offer nutritional food on their menu, and pizzerias are no stranger to this. Some pizza parlors have already offered salads on their menus, which is probably seen as a continuing trend in the years to come. (Franchise Help)

The increasing choices for pizza toppings, growing interest in gluten-free pizza, the popularity of online ordering among developed countries, and the integration of social media into product advertising are just some of the few noticeable trends happening in the pizza industry today. (BusinessWire)

Incoming 2020 reports for the pizza industry are promising, with technology leading the charge. Pizza delivery through drones and self-driving cars are some of the innovations we are currently seeing in the market right now. (Hungry Howie’s)

Homegrown ingredients are also the trend nowadays. Consumers look for locally sourced flavor and elements into their pizza. It would be therefore advisable to look for dairies, farmers, and ranches in the community to source out your ingredients and inspiration for local flavor. (Upserve)

Uber, GrubHub, Amazon, and Lyft are third-party couriers which solve many of restaurants delivery problems. Creating a good contract that is beneficial to both pizzeria and the delivery service is the key to a great partnership.

Being health-conscious, people now look for healthier options on a restaurant’s menu. Gluten-free and vegan choices are a must in every pizzeria menu. (Upserve)

The growth of the global frozen pizza industry is being driven by rising disposable income, consumers hectic lifestyle, the current wave of retail chains, as well as improvements in the standard of living. Food websites and social media presenting current food trends are also potential opportunities for global pizza market growth. (Refrigerated & Frozen Foods)

Rising preference for gluten-free and dairy-free meals, specifically with gluten and milk intolerant consumers are expected to drive the growth of the frozen pizza market. (IndustryArc)

Pizza continues to be a great value to consumers.

Despite its promising growth drivers, frozen pizza still faces an issue in its doorsteps. Frozen pizza can still be stereotyped as being unhealthy food as it is processed food that health-conscious people loathe. (Packaged Facts)

Download Our Free Template: Menu & Recipe Cost Spreadsheet

According to a report, the APAC region offers the best potential in the frozen pizza market, this is coupled with a high rate of CAGR from 2019 through 2024. (IndustryArc)

Current smartphone apps, as well as ordering online, are just some of the strategic avenues independent pizza chains can use to regain market share. (Pizza Today)

Millennials are one of the most environment-conscious people on the planet and they show this with the brands that they support. Offering eco-friendly packaging for takeout and delivery can help capture a slice of their market. (Upserve)

Food trucks and trailers are adding to the popularity of independent mobile pizzerias which are more efficient. Pizzaiolos are starting to take notice aside from brick and mortar pizzerias which see the benefit of supplementing their business with a mobile pizzeria. (Pizza Today)

Today, pizza is a billion-dollar industry not just in the U.S., but around the world. Prepared and served in traditional pizzerias, modern pizza has evolved a lot from its humble beginnings. Nowadays, pizza is served through quick-service restaurants (QSRs), delivered to your doorstep, even bought frozen which are all convenient just for us to enjoy our yummy slice of pizza.

Industry Predictions

- Dine-in focused pizza shops relying on liquor sales or game rooms for profit will continue to decline. Even after quarantines end, not everyone will feel safe eating out in public. This event is a long-term game changer.

- More reliance on third-party delivery apps like GrubHub or Uber Eats. Being listed and getting enrolled in food delivery apps will become even more important for business owners.

- Online marketing will be even more important. Being seen online and having positive reviews, updated online menus across review website like Yelp and social media will become even more.

- Pizza shops with a broader menu like wings and sandwiches will experience even greater sales in the next 12 months. It’s nice to switch things up.

- Small pizza shops unable to adapt will permanently close. This is an unfortunate reality that many small restaurants operate at razor thin margins. Local shops that relying on dine-in and pay high monthly rents will need to make difficult decisions fast to stay in business.

- Less pizza options will lead to an even larger piece of the demand will go to chain pizza shops.

Despite being a traditional staple enjoyed for centuries, the pizza industry continues to adapt change with the times while maintaining its preparation and appeal among us pizza lovers.

In these challenging times, pizza continues to be one of the most appealing categories in the restaurant industry proving its resilience once again.