Podcast: Play in new window | Download | Embed

Subscribe: RSS

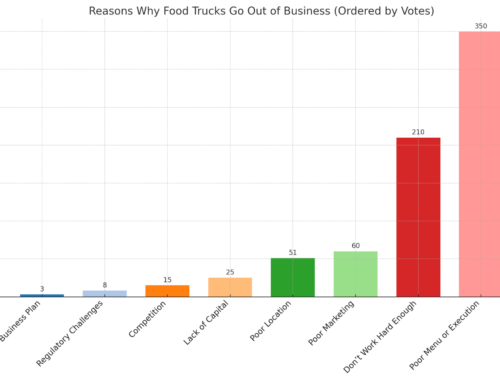

Reasons entrepreneurs are rejected from loans include poor credit, no past business revenue, the loan amount isn’t big enough or a myriad of other reasons. Often, smaller dollar value loans in particular aren’t worth the time to put together for large banks that generate revenue by charging interest. So what’s an aspiring mobile food entrepreneur to do?

The non-profit Kiva is a lending option if you are in need of a micro-loan to get your food startup off the ground. In today’s interview, we discuss with Adam Kirk from Kiva how the program works and if it’s right path for funding for you.

How to Apply for a Loan Using Kiva –

Step 1: Apply Online – The first step is creating an account and profile online. Within this online profile you’ll need to enter basic information about yourself, tell your story, goals, and why you’re seeking capital through Kiva. This step will take an hour or two on average.

This process is in ways similar to setting up a profile on crowdfunding websites like IndieGoGo.com. Lenders on the Kiva website will be able to learn more about you and your project through your profile. Be sure to invest time and effort into making sure your profile tells the right story as this will signal to lenders that you’re serious about making the business work.

Step 2: In addition to creating an account through Kiva, you will also need to answer a few basic loan application questions to be eligible. A few loan related questions include the following: How much money did you make last year? What is your credit score? How many employees do you currently have?

Step 3: At this point a “risk profile” will be created for you. This profile estimates the level of risk you are to lend to based on the information available to Kiva. Depending on the level of risk your profile contains, you will need to reach out to your personal network of friends and family to donate to your loan before your campaign goes “public” and can be viewed by Kiva’s base of 1.5 million lenders. As a simple example, you might need to find 15 people that are willing to lend to you / vouch for you before you can move to the public round. This process is called “social underwriting” by Kiva.

Step 4: At this point, your loan campaign is moved public and Kiva’s 1.5 million lenders can view and contribute to your loan. Once you reach this point in the process your odds of securing the capital you need are extremely good with about 97% of food businesses reaching this round securing the loan they need.

Note: There are three reasons you will automatically be rejected for a loan through Kiva. You must be over 18 years of age. You must be located within the United States. You must not be currently going through bankruptcy.

What You’ll Learn

- Every year 3-million loan applications are rejected in the United States

- How micro-loans can help aspiring entrepreneurs lift themselves out of poverty and benefit the overall United States economy.

- How Kiva organized and connected approximately 1.5 million lenders into one place.

- Ways the non-profit Kiva is able to make no interest loans work for lenders and entrepreneurs.

- Some examples of mobile food entrepreneurs that have successfully used Kiva to fund raise.

Quotes from the Show

The reason we’re doing this is because there’s a lot of financial exclusion in the U.S. There are tons of entrepreneurs here, there are tons of micro-businesses with less than 5 employees, but people just can’t access funding. – Adam Kirk on why Kiva can help entrepreneurs in the United States.

It helps you grow without the stress of paying ridiculously high interest rates. – Adam Kirk on the benefits of using this program for business owners just starting out.

Our food businesses, once they get to the public phase, 97% of those entrepreneurs fundraise successfully. – Adam Kirk on funding success rates.

Mentioned in the Show

Kiva – If you would like to sign up as a borrower on Kiva, click here.

The GrilledCheezGuy – Michael Davidson, owner and founder of The GrilledCheezGuy based out of the Bay Area borrowed $10,000 through Kiva to help accelerate growth for his pop-up / food truck business.

Drums & Crumbs – Kiva helped Drums & Crumbs get the working capital on they needed while their truck was being built. Drums & Crumbs serves up authentic Southern cuisine to residents of the Bay Area.